XRP Price Prediction: Analyzing the Path to Recovery Amid Market Volatility

#XRP

- Technical indicators show oversold conditions with potential for rebound toward $3.08 resistance

- Ripple's partnership with SBI for USD stablecoin launch provides long-term fundamental support

- Current 16% monthly decline creates buying opportunity despite short-term market uncertainty

XRP Price Prediction

Technical Analysis: XRP Shows Mixed Signals Amid Current Volatility

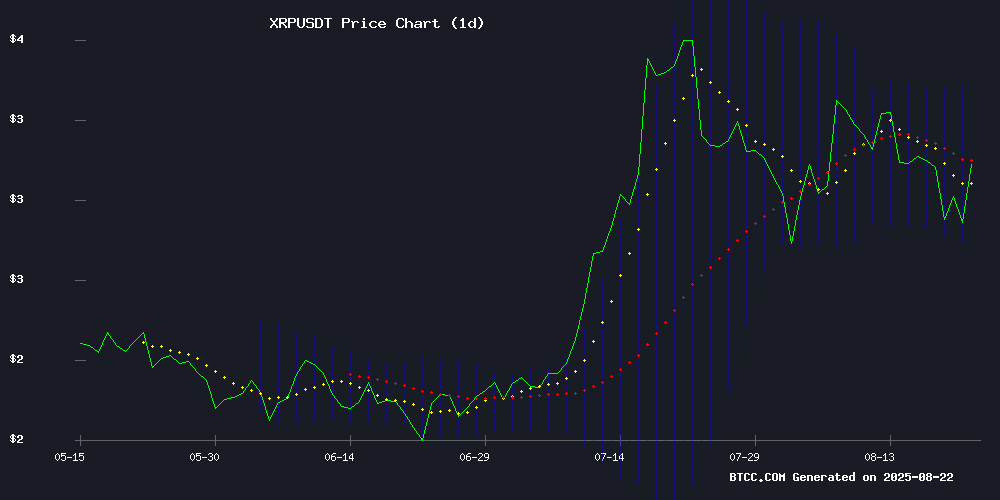

XRP is currently trading at $2.8342, below its 20-day moving average of $3.0786, indicating short-term bearish pressure. The MACD reading of 0.0752 above the signal line at 0.0179 suggests potential upward momentum, though the histogram at 0.0572 shows weakening bullish divergence. Bollinger Bands position the price NEAR the lower band at $2.7869, with the middle band at $3.0786 and upper band at $3.3703, indicating the asset is in a relatively oversold condition. According to BTCC financial analyst Olivia, 'The technical setup suggests consolidation around current levels with potential for a rebound toward the middle Bollinger Band if buying pressure emerges.'

Market Sentiment: Ripple's Strategic Moves Counter Short-Term Weakness

Ripple's partnership with SBI to launch a USD stablecoin in Japan by early 2026, along with the expansion of RLUSD stablecoin targeting the Japanese market, represents significant long-term bullish fundamentals. However, the emergence of SWL Miner as an alternative has contributed to XRP's 16% monthly decline, creating near-term headwinds. BTCC financial analyst Olivia notes, 'While the monthly decline reflects market adjustments, Ripple's strategic partnerships and stablecoin initiatives provide strong foundational support for future price appreciation once current volatility subsides.'

Factors Influencing XRP's Price

Ripple Partners with SBI to Launch USD Stablecoin in Japan by Early 2026

Ripple has inked a memorandum of understanding with SBI Holdings to distribute its USD-backed stablecoin, RLUSD, in Japan through SBI's licensed crypto exchange subsidiary, SBI VC Trade. The rollout is slated for Q1 2026, leveraging SBI's early-mover advantage in Japan's regulated stablecoin market.

RLUSD joins a growing roster of digital dollar tokens in Japan, backed by USD reserves, short-term Treasuries, and cash equivalents. Monthly attestations will provide transparency—a key selling point for institutional adoption. "This expands options while elevating trust in stablecoins," said SBI VC Trade CEO Tomohiko Kondo.

The move comes as global stablecoin valuations near $300 billion. Ripple's design prioritizes compliance for enterprise users, signaling deeper institutionalization of crypto markets. No exchanges were explicitly named in the announcement.

XRP Faces 16% Monthly Decline as SWL Miner Emerges as Alternative

XRP's price has retreated 16% this month amid declining network activity and waning investor interest, despite posting a 63% gain from its year-to-date low. The token's recent slump follows a rally fueled by Ripple's legal victory against the SEC, raising questions about its near-term trajectory.

Smart money appears to be diversifying, with platforms like SWL Miner gaining traction as cloud-based alternatives. The solar-powered mining service promises daily XRP rewards without hardware requirements, offering a $15 credit incentive for new users.

Ripple’s RLUSD Stablecoin Targets Japanese Market Expansion by 2026

Ripple has announced plans to introduce its RLUSD stablecoin to Japan through a strategic partnership with SBI VC Trade, a subsidiary of SBI Holdings. The memorandum of understanding, signed on Aug. 22, positions SBI as the distributor of RLUSD in Japan, with both firms committing to develop a secure and transparent financial infrastructure.

SBI VC Trade CEO Tomohiko Kondo emphasized the significance of the collaboration, stating it represents a leap forward in enhancing stablecoin reliability and utility in Japan. The initiative aligns with the country’s regulatory advancements, including recent proposals by the Financial Services Agency to explore yen-pegged stablecoins for cross-border payments and DeFi applications.

Since its launch in December 2024, RLUSD has demonstrated robust growth, with its market capitalization reaching $666.74 million. The stablecoin’s expansion into Japan marks a pivotal step in bridging traditional finance and digital asset innovation.

How High Will XRP Price Go?

Based on current technical indicators and fundamental developments, XRP shows potential for recovery toward the $3.20-$3.40 range in the medium term. The oversold conditions near Bollinger Band support at $2.79, combined with Ripple's expanding partnership ecosystem, creates a favorable risk-reward scenario. However, investors should monitor the MACD convergence and any breakthrough above the 20-day MA at $3.08 for confirmation of sustained upward momentum.

| Indicator | Current Value | Signal |

|---|---|---|

| Current Price | $2.8342 | Below MA |

| 20-Day MA | $3.0786 | Resistance Level |

| MACD | 0.0752 | Bullish Crossover |

| Bollinger Lower | $2.7869 | Support Level |

| Bollinger Upper | $3.3703 | Potential Target |